Sector Update / Telecommunications / Click here for full PDF version

Author(s): Giovanni Dustin ;Ryan Dimitry

- We believe that Tsel's operational data provides a positive read-through for the sector: higher data consumption and signs of further uptrading.

- Among peers, is likely to post the highest EBITDA growth yoy given its more-aggressive price hikes and cost synergies realization.

- Maintain OW with and as our preferred picks.

Tsel read-through: higher data consumption and signs of uptrading

's cellular revenue grew by +2% yoy/-3% qoq in 1Q24.We believe that Tsel's operational data provides a positive read-through for the sector. First, its data traffic rose by +4% qoq, which is against seasonality, while data consumption per sub also improved by +4% qoq; this likely indicates thatthe election and fasting period bode well for data consumption, as highlighted previously (see our previousnote). Second, Tsel's ARPU only declined by -3% qoq despite 328k subs net add qoq. While this largely reflects a full-quarter impact of its c.6% selective price hikes in Nov23, we suspect that ARPU was also partly supported byuptradinggiven that: 1) data consumption per sub also rose by +4% qoq; and 2) data yield declined by -10% qoq (or c.-6% on normalized basis, based on our estimates). We believe that Tsel's ARPU seems likely to bottom-out in 1Q24. Separately, despite the overall positive read-through, it is worth noting that Tsel's 328k subs net add qoq was likely at the expense of other telcos.

: price hikes and costs normalization to drive 1Q24 EBITDA

We expect to see topline and EBITDA growth of +10% yoy/-2% qoq and +16% yoy/flat qoq in 1Q24. Its EBITDA is likely to be in-line at around 24% of our/consensus FY24F estimates.Unlike last year, where increased its prices across-the-board by c.7.5% in Mar23, the company did not increase its prices in 1Q24. Still, its 1Q24 topline growth should be supported by a full-quarter impact from its c.8-10% price hikes in Nov23, as well as additional support from the higher traffic due to the election (c.11% higher vs. usual days) and potentially, uptrading. EBITDA growth should be also supported by lower direct expenses (given the completion of its 3G migration and some enterprise projects) and G&A expenses, as well as benign marketing costs.

: industry-high EBITDA yoy growth on price hikes and synergies

We project to see 1Q24 topline growth of +11% yoy/-3% qoq, underpinned by price hikes.Similar to , 's topline growth will also be supported by a full-quarter impact of its c.5-6% price hikes in Nov23, as well as higher traffic from the election (c.12% higher) and potentially, uptrading. This, coupled with further synergies realization, should help to supportEBITDA to grow by +20% yoy/-1% qoq in the quarter and in-line at c.24% of our/cons FY24F.Personnel and O&M expenses are likely to decline, partly offset by higher marketing costs, as is ramping up its presence in rural areas.

Maintain Overweight; and remain our preferred picks

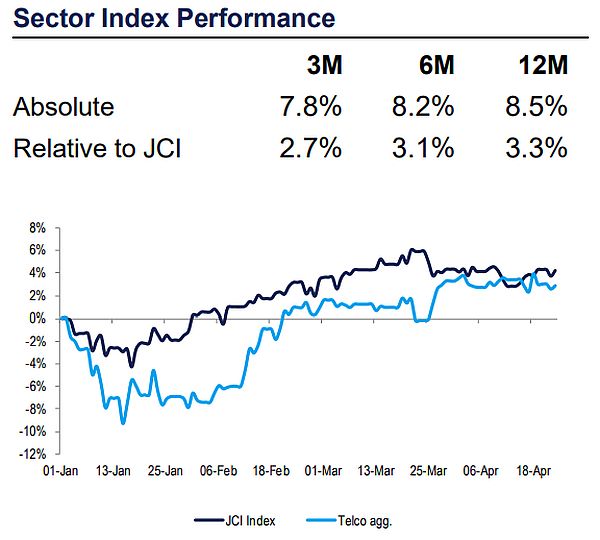

We reaffirm our Overweight stance, with Buy ratings on all names, as we continue to expect to see further monetization in the coming months. In the near-term, we expect to see in-line 1Q24 results from and (end-Apr24). Thus, we view the recent share price pullback as an opportunity to accumulate telco names. Downside risks: 1) competition; 2) higher interest rates; and 3) weak purchasing power.

Sumber : IPS

powered by: IPOTNEWS.COM